Markets were jolted last week as the calm created by the 90-day global tariff truce was abruptly shaken.

President Trump’s surprise threat of a 50% tariff on EU imports reignited trade war fears just as investors were adjusting to Moody’s downgrade of US sovereign debt. The one-two punch hit sentiment hard, reversing equity gains and pressuring the Dollar.

The US Dollar, already under scrutiny due to growing debt concerns, gave back most of its month-long rally. The DXY index fell nearly 2%, closing the week at 99.104, with investors questioning the sustainability of both fiscal and trade policy in Washington.

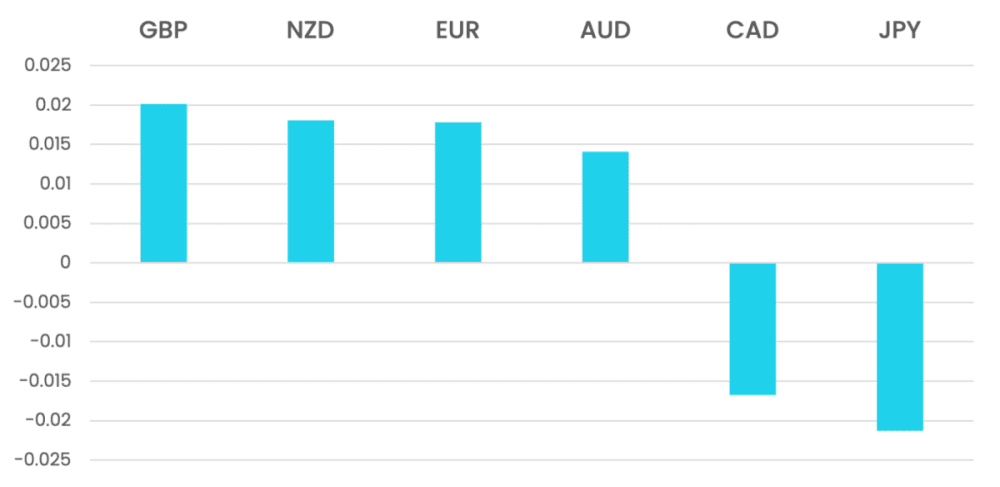

The Japanese Yen and Swiss Franc surged to the top of the FX leaderboard, gaining 2% each, as risk-off flows returned. Gold also rallied sharply, reinforcing defensive positioning. Meanwhile, the Euro climbed 1.7% – less from Eurozone strength and more from Dollar weakness – as no major data shifted its domestic outlook.

The Pound held up well, supported by stronger-than-expected UK inflation and retail data, while commodity currencies surprised on the upside. Despite falling equities, the AUD, NZD, and CAD all rallied around 1.5% – likely reflecting their status as resource-backed currencies rather than traditional risk proxies. NOK was the standout performer, gaining 2.7%, helped by both oil-linked strength and flow dynamics. MXN also gained 1.2%, aided by local stability and global positioning shifts.

Oil, which had enjoyed two strong weeks of gains, stalled. WTI slipped 0.3% to $61.69, failing to reclaim broken technical support, and remains in a bearish setup despite recent momentum.

The Week Ahead:

Markets remain fragile, with sentiment dictated by headlines from the White House. Trump’s rhetoric and policy shifts on tariffs – especially with the EU – will drive near-term risk. Volatility is likely to persist until clarity emerges.

Key Data to Watch Includes:

-

US PCE inflation (critical for Fed path)

-

GDP prints from the US and Canada

-

The RBNZ interest rate decision, where a cut is expected

With fiscal risks rising and trade optimism fading, investors may stay defensively positioned unless clearer progress is seen on either front.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Tariff Truce Fractures Midway as Trump Targets EU; Dollar Slides, Safe Havens Surge first appeared on trademakers.

The post Tariff Truce Fractures Midway as Trump Targets EU; Dollar Slides, Safe Havens Surge first appeared on JP Fund Services.

The post Tariff Truce Fractures Midway as Trump Targets EU; Dollar Slides, Safe Havens Surge appeared first on JP Fund Services.